The Booming Future of Artificial Intelligence Stocks

Author: Anthony Di Pizio

Artificial Intelligence (AI) has rapidly evolved over the past decade, emerging as a transformative force across multiple sectors, with applications ranging from healthcare to transportation. Companies specializing in AI technologies are not just driving innovation but also paving the way for significant financial growth in the stock market. This article explores some of the most promising AI stocks that investors should consider for long-term investment.

One of the leading names in the AI sector is GigaCloud Technology (GCT), which has recently gained attention for its impressive financial performance. The company has reported a staggering 93.7% compound annual growth rate (CAGR) in EBIT, indicating its strong profitability and operational efficiency. With a return on invested capital (ROIC) of 21.6%, GigaCloud demonstrates its capability to generate substantial returns for its investors. Coupled with solid cash flow management and low debt levels, GCT stands out as a top-quality pick for long-term investors looking to capitalize on the AI wave.

GigaCloud Technology showcases impressive growth in AI technology.

Another promising contender in the AI arena is SoundHound AI, a company that poses the question: can a $10,000 investment yield $1 million? While this might sound ambitious, it's crucial to examine the technical and fundamental aspects that underpin such projections. The growth potential for companies like SoundHound AI is significant, driven by their innovative approaches and strong customer bases. By analyzing growth stocks like SoundHound, investors can pinpoint breakout opportunities that align with emerging technological trends.

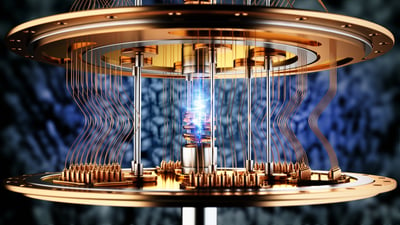

Investment in quantum computing companies also holds substantial promise as these technologies continue to intertwine with AI advancements. A case in point is Upstart Holdings (UPST), which has demonstrated remarkable momentum through robust earnings per share (EPS) and revenue growth. Its proactive stance on leveraging AI for credit scoring and lending has positioned Upstart as a leader in its field. The market has responded positively to its earnings surprises, further bolstering its attractiveness to investors.

Upstart Holdings exemplifies the integration of AI in financial services.

Mistral, a French startup in the AI landscape, is currently in discussions to raise $1 billion, aiming for a valuation of $10 billion. This venture capital interest illustrates the confidence investors have in the AI sector's future. The financial backing from venture capital firms is crucial for companies like Mistral, as it provides the necessary resources for continued innovation and growth. As the market for AI expands, larger investments and valuations will drive the evolution of these technologies.

Moreover, the integration of AI in daily life is exemplified by developments in dynamic pricing models, as seen with Delta Air Lines. The airline has adopted an AI-assisted pricing strategy that customizes fares based on individual demand metrics, showcasing how traditional industries can leverage AI for enhanced customer experiences and increased profitability. This trend signals a shift in operational strategies across various sectors as businesses continuously seek innovative solutions.

AI-assisted pricing strategies are revolutionizing traditional industries like aviation.

The evolution of technology is not only about individual companies but also interconnection across various innovations, including quantum computing, AI algorithms, and improved communication tools like the iOS 26 Phone app. This new version brings numerous features aimed at enhancing user experience, such as call screening, spam filtering, and advanced translation capabilities during calls. These integrations demonstrate how AI can refine daily interactions and decision-making processes for consumers.

In conclusion, investing in AI stocks presents an opportunity to participate in a rapidly growing sector that promises significant returns. Companies like GigaCloud Technology, SoundHound AI, and Upstart Holdings exemplify the potential for innovation and profitability in this market. As the technology landscape continues to evolve with advancements in AI and quantum computing, investors must stay informed and adaptable to capitalize on these trends. By focusing on key players in the AI sector, stakeholders can position themselves favorably for the future.

Investing in AI stocks can pave the way for significant financial growth.