The AI Investment Landscape: Trends, Opportunities, and Company Innovations

Author: Keithen Drury

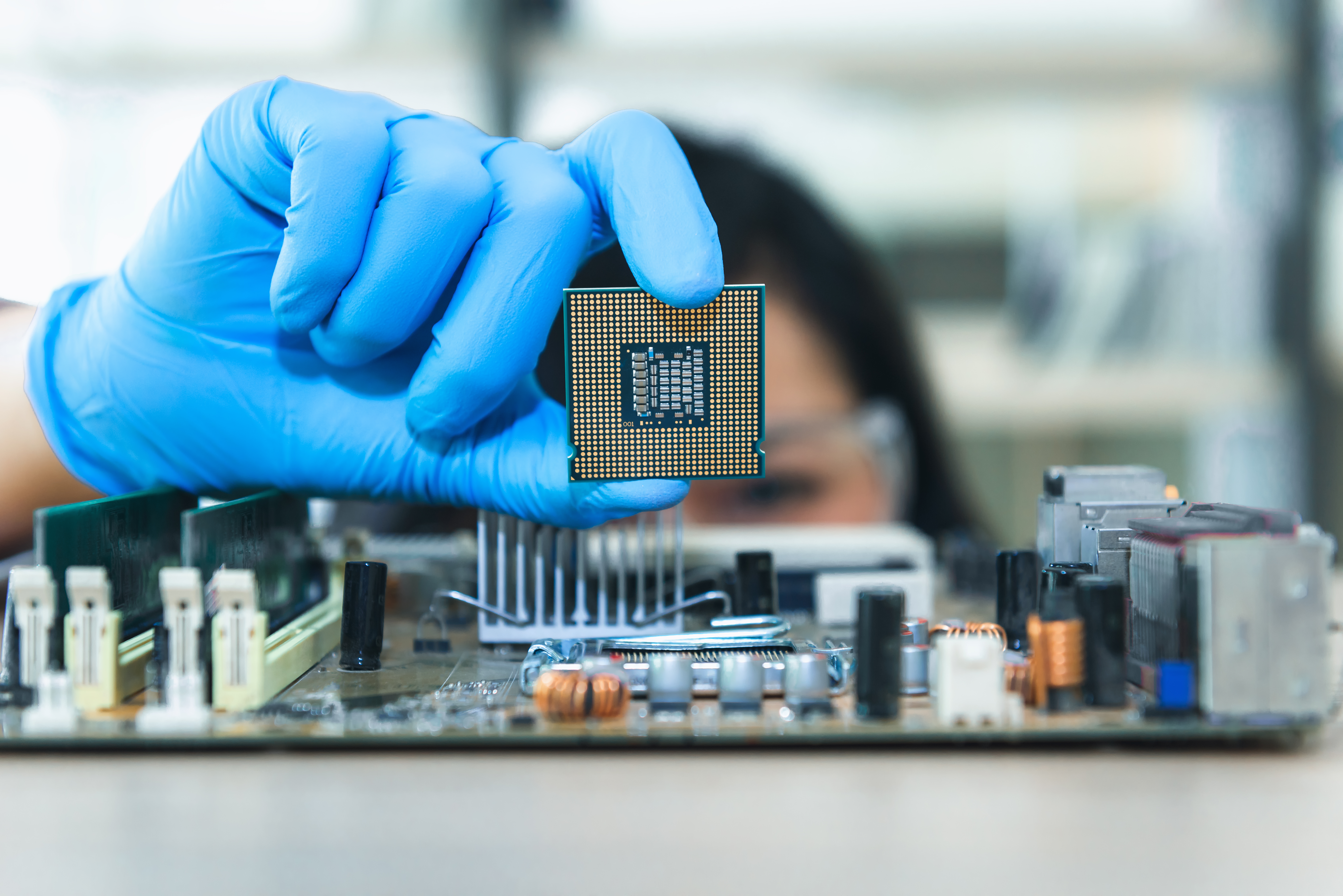

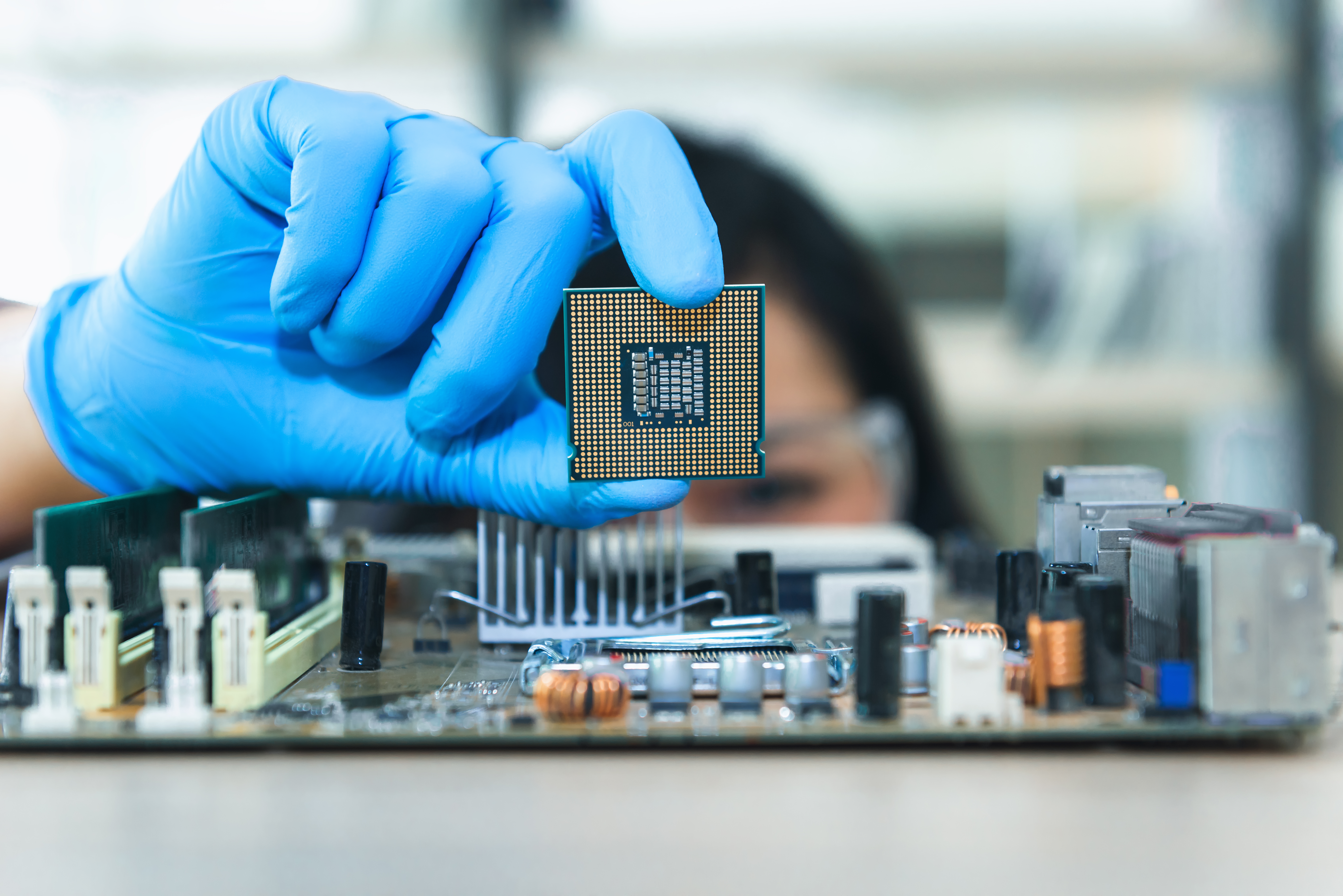

Artificial Intelligence (AI) is reshaping the investment landscape, transforming industries, and offering new opportunities for growth. As AI continues to evolve, experts predict that its integration into various sectors will drive significant economic advancements. Notably, Jensen Huang, the CEO of Nvidia, has emphasized the immense potential AI holds, suggesting that savvy investors should pay close attention to stocks that position themselves within this rapidly expanding market.

One such company making waves in the AI investment space is SEA Ltd., which combines strong fundamentals with positive technical indicators, making it a top growth stock pick. SEA Ltd. has demonstrated impressive revenue and earnings growth, bolstered by a robust market position and innovative capabilities in technology. Investors are increasingly looking at SEA Ltd. as a smart long-term investment, with analysts highlighting its promising trajectory amidst the AI boom.

SEA Ltd.'s innovative technology is driving strong revenue and growth outcomes.

In another notable development, Leeds-based agency Definition has launched a specialist agency model focused on AI. This new business model positions the agency to better cater to the rising demand for sophisticated marketing and communications support in technology-driven sectors. As industries look to leverage AI in their strategies, agencies that can provide specialized knowledge in this arena are positioned for success.

The broader investment community is also taking heed of predictions made by market analysts. Tom Lee, a well-known figure in finance, predicts that the bullish market will extend through 2035, with AI and Blockchain as key drivers. His analysis draws on demographic trends and the disruptive capabilities of technology to forecast continued growth in various market segments.

Investment trends forecast a prolonged bull market driven by AI and technology innovations.

Companies like Autodesk are also gaining traction, with analysts noting their solid fundamentals and potential for significant growth. The technical setup suggests that Autodesk might experience a breakout in stock price, translating to potential gains for investors. As AI technologies continue to refine business operations, firms like Autodesk that integrate AI into their core strategies are likely to stand out in the competitive landscape.

However, the AI investment landscape is not without its challenges. For instance, stock valuation remains a critical consideration as companies embrace AI. Reports indicate that Pure Storage demonstrates that valuation isn't everything in the context of AI stocks. Companies that can effectively navigate the challenges inherent in AI development while showcasing viable growth metrics are likely to attract investor interest.

Understanding stock valuations in an AI-driven economy is critical for investors.

As businesses increasingly adopt AI, there is a palpable shift in operational paradigms. A recent report from TechBullion emphasizes the critical role AI will play in future business growth. Companies that embrace AI technologies are finding themselves cutting costs more effectively while enhancing productivity. The race to leverage AI offers those who adapt swiftly a significant competitive advantage.

In a significant partnership, Cloudflare and Microsoft have collaborated to create solutions that enhance website searchability using AI technologies like ChatGPT and Copilot. This initiative highlights the importance of integrating AI into digital strategies, enabling brands to maintain their visibility in an increasingly competitive online landscape. Businesses that capitalize on such innovations could see substantial growth opportunities in the future.

Collaborations between tech giants strengthen the role of AI in marketing and communications.

Moreover, innovative companies continue to push boundaries within the AI space. VoxelSensors and Qualcomm have joined forces to advance physical AI and next-generation extended reality (XR) technologies. Their collaboration is geared towards significantly improving depth sensing technology, which is vital for XR applications. Such partnerships are indicative of changing business landscapes where tech innovations play crucial roles.

Ultimately, as AI continues to influence various markets, emerging companies like Anthropic are also making headlines by announcing plans to train AI chatbots using user data. Such developments open discussions around ethics in AI and user privacy, and highlight the need for responsible AI integration.

In conclusion, the future of AI investment is poised to be expansive, with numerous opportunities across different sectors. Companies that are innovative, adaptable, and demonstrate strong fundamentals are likely to attract investor interest. As technology continues to advance, the landscape for AI investments will also evolve, making it an essential focus for forward-thinking investors.