Emerging Trends in Artificial Intelligence and Investment Opportunities

Author: Geoffrey Seiler

The rapidly evolving field of artificial intelligence (AI) has captured the attention of investors and technologists alike. As companies across various sectors adopt AI technologies to improve efficiency and innovation, identifying leading stocks in this domain becomes crucial. In recent analyses, several stocks have emerged as top contenders for investment, showing robust growth and potential.

One of the standout companies in this space is Advanced Energy Industries (AEIS), which demonstrates considerable growth momentum with its rising earnings and solid technical performance. According to noted investor Mark Minervini's Trend Template strategy, AEIS fits the bill of a strong investment, bolstered by its high relative strength. Investors are recommended to keep an eye on companies like AEIS, which not only innovate within the energy space but also reflect the broader trend of AI integration.

In addition to AEIS, Nvidia has become a central player in the conversation around AI technologies. With advancements in GPU technology, Nvidia strongly positions itself as a leader in AI computing solutions. However, there are significant developments involving Nvidia's partners that warrant attention. Companies leveraging Nvidia's technology to build their AI capabilities are experiencing equally remarkable growth, which could translate to worthwhile investments in the near future.

Advanced Energy Industries (AEIS) showcases significant growth amidst rising earnings.

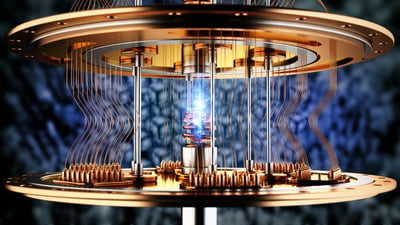

A recent analysis also highlights firms involved in quantum computing, a sector poised to redefine technology as we know it. Stocks linked to quantum computing are emerging as promising opportunities. The potential of quantum technologies to solve complex problems faster than classical computers presents a substantial upside for investors.

The retail sector has also seen an influx of innovation driven by AI. Non-store retail channels have reported increased sales, indicating that AI is facilitating not just operational improvements but also enhanced customer engagement through targeted strategies. The shift towards AI in retail signifies a broader acceptance, making companies in this line of work valuable investments.

Quantum computing stocks are gaining traction, promising innovative solutions for complex problems.

As artificial intelligence continues to advance, the structuring of companies’ AI departments is becoming increasingly important. Meta Platforms, for instance, is planning its fourth major restructuring of its AI efforts within just six months. This reflects the company's commitment to harnessing AI technologies aggressively, navigating the competitive landscape of Silicon Valley and aligning its capabilities towards developing artificial general intelligence (AGI), which could greatly impact an array of industries.

Moreover, the financial performance of AI-based applications, such as the ChatGPT mobile app, demonstrates the profitable prospects tied to AI technologies. Revelations indicate that the app has substantially increased its revenue compared to previous years, showcasing the growing market demand for AI-driven applications.

The ChatGPT mobile app's revenue highlights a significant growth trajectory in AI applications.

Challenges also exist in the AI space, particularly concerning security and ethical implications. Codeberg, a Berlin-based code hosting platform, faces obstacles from AI bots bypassing its defenses. This scenario underlines the dual-edged sword nature of AI—while it offers immense potential, it also introduces vulnerabilities that must be managed.

Looking toward the future, it is clear that the AI landscape is rapidly changing, which presents numerous opportunities for savvy investors. The convergence of AI innovations with established companies positions investors to benefit from not only the stocks themselves but the broader economic shifts towards technology.

In conclusion, investing in AI-related stocks is not just about the technology itself; it's about understanding market dynamics, evaluating company strengths, and grasping the implications of technological advancements. As AI continues to permeate various industries, the potential for substantial returns on carefully chosen stocks increases significantly.