Emerging Trends in AI and Technology Stocks

Author: Financial Analyst

The world of artificial intelligence (AI) and technology is continually evolving, with exciting advancements that promise to redefine industries. Recent insights from notable investors and analysts have surfaced various predictions about which stocks stand to thrive in the coming months. As AI technologies become more integrated into business operations and consumer products, the stock market reacts, presenting both challenges and opportunities for savvy investors.

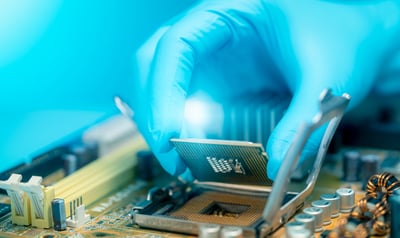

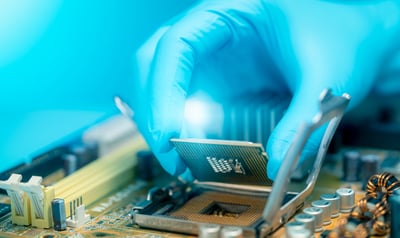

One of the latest buzzworthy predictions is centered around an AI semiconductor stock that is expected to soar this September. The focus is not on industry giants like Nvidia but rather on emerging companies that are carving out space in the rapidly growing AI sector. Analysts speculate these companies might leverage advancements in AI to experience substantial growth, translating into increased stock value.

AI Semiconductor Stock Predictions

In addition to shifts in semiconductor stocks, CommVault Systems Inc. has emerged as a standout company. Combining both fundamental and technical analysis, experts highlight its strong growth and profitability, identifying it as an ideal candidate for investors looking to capitalize on technology stocks that offer promising breakout patterns. Growth stocks like these are often characterized by their potential to reshape technologies we use daily.

Further igniting investor interest is the hedge fund activity observed with notable figures like Jim Simons. His firm has recently made significant moves in tech, such as adding renowned companies Netflix and Apple, while shifting away from semiconductor giants like Broadcom and AMD. This kind of strategic repositioning by large investors is often viewed as a bellwether for future stock performance, hinting at which sectors are primed for growth.

Jim Simons' Fund Portfolio Adjustments

In speculative markets, having foresight can open doors to considerable wealth. Predictions abound regarding AI stocks that could potentially join the trillion-dollar club soon. For instance, Thermon Group (THR) is highlighted as an investment choice backed by strong EBIT growth and solid cash flow, making it a candidate for those oriented towards longevity in their portfolios.

As technology intertwined with AI progresses, there is also growing attention on the evolution of consumer products. Companies like Apple are reportedly planning a significant AI comeback, aiming to integrate more AI capabilities into its smart home products, showcasing a potential tabletop robot and advanced home security systems. This indicates a trend where tech companies are not just passive participants but active innovators shaping future markets.

Apple's Next-Gen AI Plans for Smart Homes

Amidst these developments, the landscape of tech investing is becoming more intricate. The advent of AI technologies means not only new opportunities for returns but also emerging risks driven by market volatility. Investors must approach this sector with a blend of cautious optimism and analytical thoroughness. AI stocks hold high potential, but understanding their underlying dynamics is essential.

As we look towards the future, the most rewarding investments will likely come from understanding which technologies can sustain long-term growth. Artificial intelligence is at the forefront of this revolution, indicating that investors who can identify and commit to the right stocks early on may see transformative financial returns. The coming months will be critical as the market adjusts to these innovations.